Corporate Green Initiatives- Shareholder Value

Image credit: 2022 Impact Report

Image credit: 2022 Impact Report

In the realm of corporate sustainability, few companies have made as significant an impact as Tesla, Inc. Founded in 2003 by a group of engineers who wanted to prove that electric vehicles could be better, quicker, and more fun to drive than gasoline cars, Tesla has grown to become a leader in green technology and a beacon for sustainable business practices. This blog will explore Tesla’s commitment to sustainability, its impact on the company’s stock price, and its overall shareholder value.

Tesla’s mission is to accelerate the world’s transition to sustainable energy. This commitment is evident in every facet of the company’s operations, from its electric vehicles (EVs) to its energy products. Tesla’s sustainability initiatives can be broadly categorized into three areas:

Tesla’s EVs are designed to replace traditional internal combustion engine vehicles, reducing greenhouse gas emissions and dependence on fossil fuels. The company’s models, including the Model S, Model 3, Model X, and Model Y, have set industry standards for performance, safety, and range.

Beyond cars, Tesla produces energy solutions such as solar panels, Solar Roof, and the Powerwall. These products allow homes and businesses to generate and store renewable energy, further reducing carbon footprints.

Tesla’s Gigafactories are designed to be the most advanced and sustainable manufacturing facilities in the world. The Gigafactory in Nevada, for example, is intended to be powered entirely by renewable energy, aiming for zero emissions in its production processes.

Tesla’s commitment to sustainability has had a profound impact on its stock price, making it one of the most valuable car manufacturers in the world. Here’s how sustainability has influenced Tesla’s market performance:

Tesla’s strong commitment to sustainability has attracted a broad base of investors who prioritize environmental, social, and governance (ESG) criteria. This has helped Tesla secure a premium valuation compared to traditional automakers.

Tesla’s continuous innovation in green technology keeps it ahead of competitors. The company’s advancements in battery technology, autonomous driving, and renewable energy solutions have driven investor optimism and sustained high stock prices.

As a pioneer in the EV market, Tesla has benefitted from being perceived as a market leader. This status has not only boosted consumer demand but also driven investor enthusiasm, further propelling its stock price.

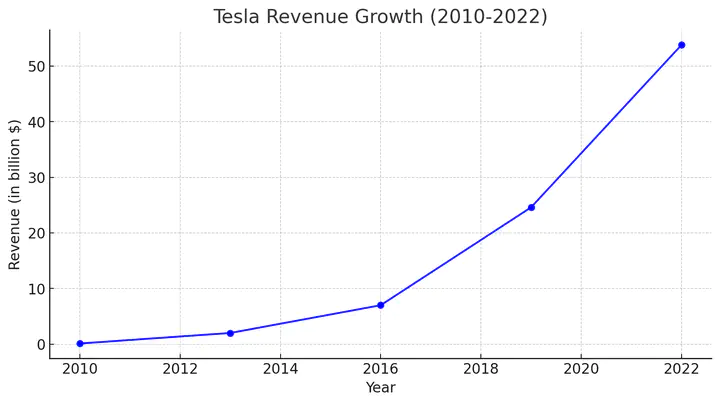

Since its initial public offering (IPO) in 2010, Tesla’s stock has seen exponential growth. Key milestones such as the introduction of the Model S, the launch of the Gigafactory, and the consistent delivery of quarterly profits have led to significant upticks in its stock price. As of 2022, Tesla’s market capitalization often places it among the top automotive and tech companies globally.

Tesla’s sustainability initiatives have translated into substantial shareholder value through several channels:

Consistent revenue growth, coupled with the company’s ability to scale its operations while maintaining profitability, has ensured robust financial performance. Tesla’s revenue increased from $24.6 billion in 2019 to over $53.8 billion in 2022, reflecting its growing market presence and operational efficiency.

Tesla’s brand is synonymous with innovation and sustainability. This strong brand equity attracts not only customers but also top talent and strategic partners, further enhancing shareholder value.

Tesla has entered into several strategic partnerships that bolster its sustainability mission and financial health. Collaborations with companies in the renewable energy sector and advancements in autonomous driving technology have solidified its market position.

Tesla’s vision for a sustainable future resonates with long-term investors. The company’s strategic focus on sustainable innovation ensures that it remains relevant and continues to grow, providing sustained returns for shareholders.

Tesla, Inc. exemplifies how a strong commitment to sustainability can drive not only environmental benefits but also substantial shareholder value. By leading the charge in electric vehicles and renewable energy, Tesla has managed to achieve impressive financial performance and market valuation. The company’s innovative approach and strategic vision ensure that it remains a valuable and influential player in the transition to a sustainable future.

As Tesla continues to push the boundaries of what’s possible in green technology, it sets a powerful example for other corporations on the tangible benefits of investing in sustainability. For shareholders, Tesla’s journey underscores the potential for significant financial returns when a company aligns its operations with the pressing need for environmental stewardship.

References

- Tesla Inc. (2022). 2022 Impact Report. Retrieved from Tesla’s Impact Report.

- MarketWatch. (2022). Tesla Inc. Stock Price & Financials. Retrieved from MarketWatch.

- S&P Global. (2021). Tesla’s ESG Score. Retrieved from S&P Global.

- NASDAQ. (2022). Tesla Historical Stock Prices. Retrieved from NASDAQ.